The Form 1098-T is a tuition statement that colleges and universities are required to issue to most students who paid for “qualified tuition and related expenses” (“QTRE”) in the preceding calendar year. Qualified educational expenses include tuition and mandatory fees that are required for your courses.

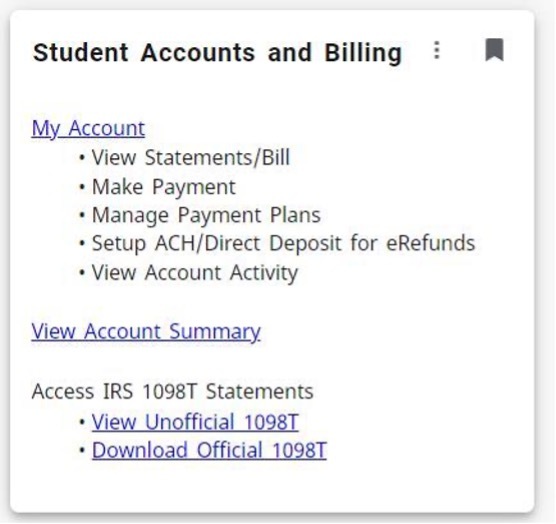

Tax Form 1098-T is issued to eligible students annually by January 31 and can be accessed at any time online to view, save, or print a copy for your records.

The dollar amounts reported on your 1098-T Tax Form may assist you in completing IRS Form 8863. Your bills and your receipts are also helpful resources for purposes of calculating the education tax credits that a taxpayer may claim as part of your tax return.

While the CT State Business Office cannot provide tax advice, here are some answers to frequently asked questions. You may also visit the IRS website Publication 970, or contact a tax professional for more information about your ability to claim a tax deduction or tax credit.

Students also have the option to view and download the 1098-T from the Maximus website. The link to the Maximus login page is https://tra.maximus.com. The student can create an account by clicking on First Time Students. Once the account is created, the student can then enter a User ID and Password and click on Loginwithin the main webpage.

Please note that we are unable to email or fax the form to anyone.

Box 1 includes the total amount of payments received for Qualified Tuition and Related Expenses that were billed between January 1 and December 31. Qualified tuition and fees do not include housing, food, insurance, medical expenses, transportation, and similar personal, living, or family expenses. The focus of Box 1 is on direct educational expenses necessary for enrollment and attendance at CT State. They include all payments from all sources, such as:

Any refunds you received, waivers, or any payments made that were returned by the maker's bank are reflected as a reduction of these total payments.

Please be advised that amounts paiddo not represent amounts billedby CT State during the calendar year. The amount in Box 1 represents amounts paid and posted to your student account in the appropriate calendar year.

To ensure accurate reporting on your tax return, you should keep track of all payments you make toward qualified tuition and related expenses, even if they fall outside the calendar year covered by the 1098-T. You may need to manually include these payments when preparing your tax return for the relevant tax year.

Box 5 of Form 1098-T reports the total amount of scholarships or grants administered and processed by CT State for the calendar year. If Box 5 is higher than the amount you paid for qualified tuition and related expenses (reported in Box 1), it could be due to a few reasons:

For questions regarding Form 1098-T that are not answered here, please contact your home campus bursar/business office.